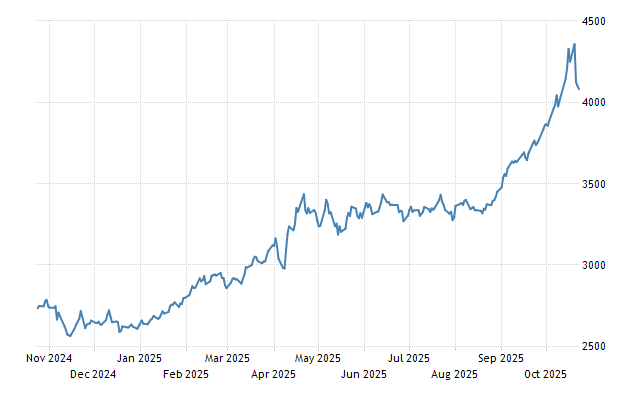

The gold market just experienced a seismic event. Following an aggressive, record-breaking rally, the gold price crash of October 2025 shocked investors globally. Spot gold plummeted over 5% in a single day. This represented the steepest one-day fall in over a decade. It instantly erased weeks of gains. The precious metal tumbled from a record high near $4,380 per ounce on Monday to trade around the $4,000 level. This sudden volatility begs a critical question for every investor: Does this correction signal the end of the monumental bull run, or does it offer a golden buying opportunity?

Why Did Gold Fall So Hard?

Several powerful forces converged to trigger this abrupt gold decline. Gold had surged nearly 60% this year alone. This created an extremely overbought technical condition. The market was simply ready for a pullback.

First, aggressive profit-taking became the most immediate catalyst. Many short-term traders rushed to lock in their historic gains. This produced a cascade of selling orders. This overwhelmed the normal buying interest at those elevated levels.

Second, a shift in global sentiment reduced gold’s safe-haven appeal. Markets cheered optimism about a potential U.S.-China trade deal. Signs of thawing tensions between Washington and Beijing encouraged investors. They rotated money out of safe-haven assets. They moved capital into higher-risk equities. This is a classic “risk-on” move.

Read More : Gold Prices in Pakistan Today: Why the Gold Hit an All-Time Record High

Third, the U.S. dollar strengthened against other currencies. Gold is denominated in the dollar. A stronger dollar makes the metal instantly more expensive for international buyers. This naturally dampened global demand. This combination of factors quickly flipped market sentiment from “fear of missing out” to “fear of a market top.” The decline on Tuesday extended through Wednesday, cementing the correction phase.

Is the Gold Rally Truly Over?

Market analysts largely view this sharp drop as a necessary technical correction, not a fundamental reversal. Gold’s key long-term drivers remain powerfully intact.

The long-term outlook for gold remains strongly constructive. Experts point to persistent global economic uncertainties. Central banks are consistently buying gold at historic levels. This institutional demand creates a robust floor for the price.

Furthermore, investors still anticipate further U.S. Federal Reserve rate cuts later this year. Lower interest rates decrease the opportunity cost of holding non-yielding gold. This expectation continues to provide underlying support for the yellow metal. Major institutions maintain highly bullish forecasts. Some banks predict gold could reach $5,000 per ounce by 2026. They cite ongoing global debt and currency debasement concerns.

Technical Levels and What to Watch Next

The $4,000 per ounce mark now acts as a crucial psychological support level. Gold must hold this zone to maintain its long-term bullish structure.

A sustained break below $4,000 could signal a deeper short-term correction. This might target the $3,950 or even $3,850 support zones. Conversely, a successful bounce off the $4,000 level would confirm its strength. It would pave the way for a rebound toward the $4,185 resistance area. The long-term technical trend remains healthy. The price continues trading above its 100-day Exponential Moving Average.

Investors should closely monitor the forthcoming U.S. CPI data release. This report will guide expectations for the Federal Reserve’s next policy decision. Any delay or change to the expected rate cuts could reintroduce significant short-term volatility.

Strategy for Investors: Buy the Dip or Wait?

The gold price crash presents a moment of truth for all gold investors. Short-term momentum traders experienced a painful shakeout. Long-term investors, however, can view this volatility as a chance to accumulate.

- Long-Term Investors: Consider this dip a potential entry point. Use a systematic investment plan (SIP). Accumulate gold in tranches on weakness. This helps mitigate price volatility. Sovereign Gold Bonds or Gold ETFs offer excellent options for passive exposure.

- Jewellery Buyers: The price correction offers a welcome reprieve. Consumers eyeing purchases for the upcoming wedding season can leverage the softer prices.

- Traders: Extreme caution is necessary. The market is highly volatile. Use strict risk management rules and stop-losses. Wait for the consolidation phase to confirm before taking new directional bets.

Ultimately, the recent Gold price crash was a necessary reset. It was not a death knell for the gold bull market. The fundamental drivers supporting gold’s rise remain strong. While volatility will persist, investors who adopt a disciplined, long-term perspective will likely benefit. They should view this sharp correction as a temporary detour, not an end to the golden journey.

FAQs Gold Price Crash

Q1. What caused the huge gold price drop?

Profit-taking by traders after a massive rally caused the initial sharp drop. A stronger U.S. dollar and easing U.S.-China trade tensions also reduced gold’s safe-haven appeal.

Q2. How significant was this gold price fall?

The price drop was highly significant. Spot gold plunged over 5% in a single day, representing the steepest one-day decline in more than a decade.

Q3. Is the gold bull market officially over now?

No. Analysts mostly see this as a healthy technical correction. Long-term drivers like central bank buying and low real interest rates still support gold’s outlook.

Q4. What price level should investors watch now?

Investors must watch the $4,000 per ounce psychological support level closely. Holding this price is key for maintaining the metal’s long-term uptrend.

Q5. Should long-term investors buy gold right now?

Yes, long-term investors can consider this dip a potential buying opportunity. They should accumulate gold systematically to manage the current high volatility.

For More Latest News & Update : Visit Our Page